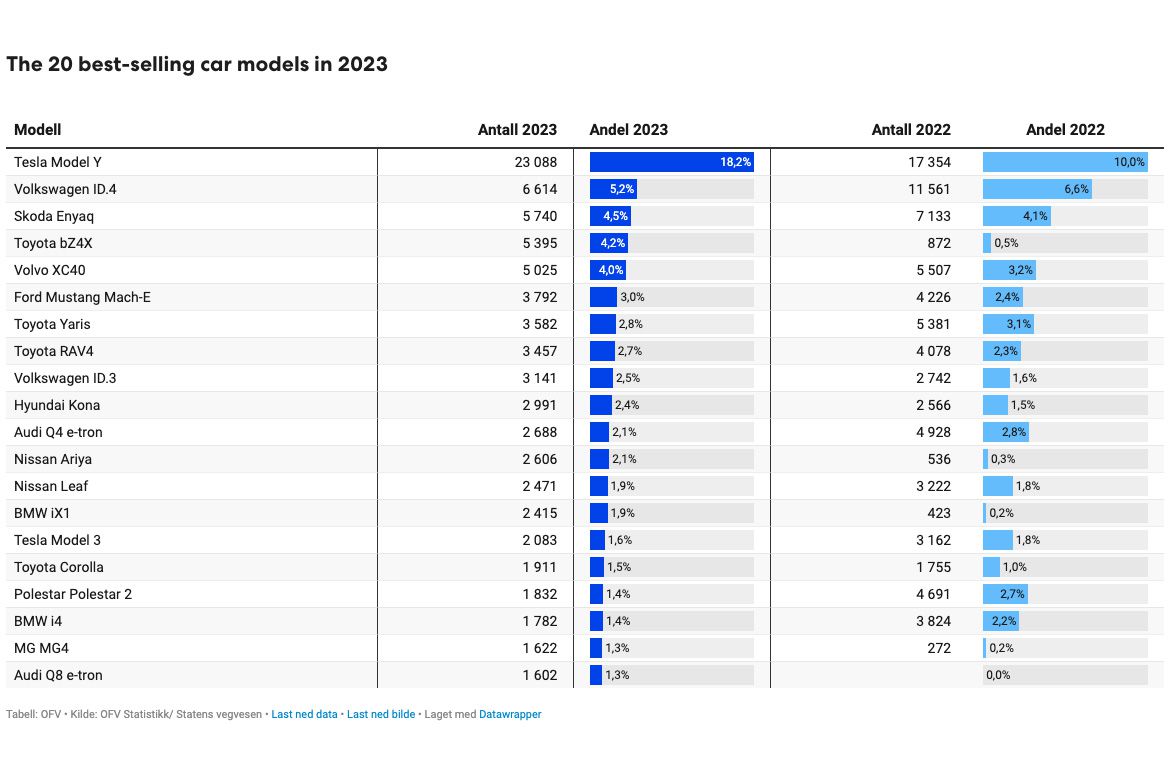

Over 80 percent of new cars sold in Norway were electric in 2023::New figures released by the Norwegian Road Federation say 82.4 percent of new cars sold in the country last year were electric, up from 79.3 percent in 2022. Tesla, Toyota, and Volkswagen were the most popular brands, with Tesla’s Model Y making up almost a fifth of new sales. Reuters notes that Norway intends to end the sale of new petrol and diesel cars in 2025.

In this case it’s a self charging meaning the electricity is 100% generated by an ICE motor. Meaning the driving energy is 100% Gas.

Doesn’t matter that the gas energy is used to generate electricity, it’s still 100% gas, and can easily be measured as such, and taxed as such.

Plugin Hybrids are a bit different, but are still not electric, and shouldn’t enjoy the tax benefits of being electric, and shouldn’t be included in stats for electric, because they are not.

Plugin hybrids arent ice either. I can drive my audi a3 full electric for as long as there is charge in the battery.

I agree they need to be seperated in statistics, but law wise, keep them as electric. They are a good stepping stone to prepare us for whats to come

Next year it will be illegal to sell any kind of ICE car in Norway, including hybrid / plugin hybrid. So at least Norway doesn’t agree.

Also we have made tests in Denmark, that shows that Hybrid does not come even close to live up to the promises of car makers, that were the basis for tax deductions.

I understand the advantage of Hybrid, combining electric and long range at lower cost, but they are not the same as a fully electric car, and shouldn’t share those tax advantages.

Fair, in regard to tax advantagea they shouldnt be the same as electric. I agree with that.

Its stupid that my audi has the same tax advantages as a kia ev6 despite it beeing bad, and if not worse, for the environment.

But i wouldnt say that law wise they should be considered like ice cars, They arent that. Optimally, they should be considered what they are : hybrids, a step between ice and ev. They arent ice and they arent ev’s either. Yet, as is, nobody looks at hybrids so we just deal with them like ev’s. Better that than ice imo or i, as a single guy renting a place, would be royally fucked that i would be forced to take a ev i cant charge at home or ice that i would pay a shit ton for

Self charging hybrid is easy, they should be considered ICE no doubt IMO.

But I agree it’s more difficult with plug in hybrid. Because they may drive 90% as an EV, or they may drive 90% as an ICE car, that was just cheaper because it had a tax advantage.

Problem is if you tax them close to EV, it will be exploited by people who kind of use them just like ICE cars.

However in Norway it will soon not matter much, because all cars that have any kind of Internal combustion engine, is considered ICE, and will be illegal to sell from 2025!

Maybe a bit dramatic, but if they are already at 80% EV of new car sales, they are definitely on track.

Oh ye, in the case with norway, if electric is working then fuck hybrids!

They are more efficient than pure ICE vehicles though in most situations.

At low speed and city driving the regenerative breaking can make a 30mpg motor into a 50-60 mpg motor.

I drove one for awhile and the efficiency is noticable.

Yes absolutely, I’m not saying self charging doesn’t have merit, it’s just not an electric, but only a more economic ICE car.

I agree they shouldn’t be lumped in with EVs for statistical purposes, but they also shouldn’t be treated the same as ICEs or hybrids. There should still be some measure of the incentives (and penalties) associated with EVs.

We got a tax break when we bought our PHEV, but a lower one than a full EV would get. We also pay more each year for our vehicle registration for road maintenance (since we pay less in gas tax), but less than a full EV would. This all seems fair to me since we can get anywhere from 25-40 miles of pure EV usage on a full charge (depending on how hard we’re driving and how cold it is outside). We’re averaging around 120mpg over the life of the vehicle, far better than a non-plug-in hybrid could hope to achieve.

I suppose the easy solution would be to increase tax on gas, and lower it on electricity. That would also be the most fair IMO, but apparently people don’t want that?

But that would make the hybrid more beneficial according to the gas savings. IDK maybe that somehow isn’t entirely fair either?

Wow, that’s actually quite good. Congrats.

It really depends on exactly what you’re measuring and what your goals are (and thus, what the law does/should say). Is the goal to reduce the amount of fuel (petrol) used? Then yes, tax incentives should apply via whatever metric you’re using. If the goal is to incentivize a switch to a different fuel source, regardless of efficiency, then no.

Many people with plugin hybrids only add gas a few times per year. The (small) battery is enough for them ~95% of the time. For most (but not all) purposes, that would count as an EV. I can see your point about them not being the same, and why it would need to be handled separately, but it feels too absolutist. There are certainly shades of gray in it.

Yes, but as an ICE car, not as an electric, I think most countries have this by now, that cars are taxed lower if their mileage is better. But for electric it’s even lower, because they drive on partially renewable energy from the power grid, and they don’t pollute in cities. Those factors don’t apply for Hybrid cars.

Yes and that’s the basis for their tax rebates here, but the research shows that the level of gas used for hybrids is way higher than manufacturers promised. People generally buy hybrid because they have recurring situations where they need the extended range the gas provides. So in general a hybrid is driven quite a lot on gas. If you don’t have that need, you might as well buy an electric. Ergo Hybrids should at most receive half the tax rebate IMO. And they should never be counted as electric, because they are not.